Crypto Forecasts: Why Your 2025 Predictions Are Wrong

Crypto in 2026: Regulation Meets Reality

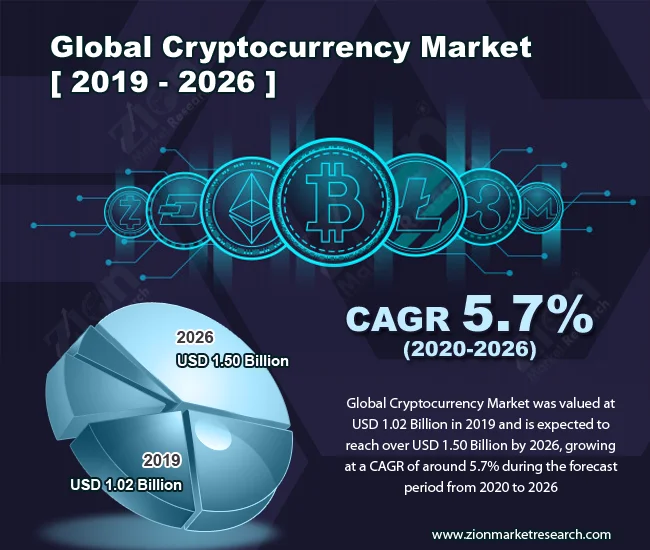

The crypto landscape in 2025 was defined by two seemingly contradictory forces: increasing regulatory clarity and persistent market volatility. TRM Labs' review of crypto policy in 30 jurisdictions, representing over 70% of global crypto exposure, highlights a global push for consistent regulation, particularly around stablecoins. Giann Liguid noted the SEC’s decision to freeze ultra-leveraged ETF approvals, and that, coupled with the Strategy Shares' MSCI Index removal, paints a cautious picture, but one that's not entirely unexpected. As someone who used to sift through financial statements all day, I can tell you that the real story is often buried deep in the footnotes.

Stablecoins Take Center Stage, Institutions Edge In

Stablecoins emerged as a focal point for policymakers worldwide, with over 70% of jurisdictions progressing stablecoin regulation in 2025. The US, with its GENIUS Act, and the EU, with its MiCA rollout, articulated standards for issuance, reserves, and redemption. Meanwhile, institutional adoption was fueled by this regulatory clarity, with financial institutions in about 80% of the reviewed jurisdictions announcing new digital asset initiatives. This is where things get interesting. The Basel Committee, initially proposing strict capital deductions for crypto assets, including certain stablecoins, agreed to reassess its rules, signaling a potential softening of regulatory attitudes regarding banks' engagement with digital assets.

But let's not get ahead of ourselves. The question isn't just about more regulation, but better regulation. Are these new frameworks truly fostering innovation, or are they simply erecting higher barriers to entry? I've seen firsthand how regulatory overreach can stifle even the most promising sectors, turning them into playgrounds for established players with deep pockets. So, while the headlines might scream "clarity," the real impact will depend on the fine print.

Impact of Regulation on Illicit Finance

The Global Crypto Policy Review & Outlook 2025/26 report emphasized the undeniable impact of regulation on illicit finance. Global Crypto Policy Review Outlook 2025/26 Report TRM analysis found that virtual asset service providers (VASPs), the most widely regulated segment of the crypto ecosystem, have significantly lower rates of illicit activity than the overall ecosystem. North Korea’s record-breaking hack on Bybit, resulting in over USD 1.5 billion in losses, highlighted the need for better cross-jurisdictional coordination and real-time information sharing. The attackers laundered proceeds through unlicensed over-the-counter (OTC) brokers, cross-chain bridges, and decentralized exchanges – infrastructure that largely sits outside existing regulatory perimeters.

A Fragmented Global Landscape

Despite the global push for consistency, the crypto regulatory landscape remains fragmented. The report highlights jurisdictional developments across the Americas, Europe, the Middle East, Africa, and Asia Pacific. Each region is taking a unique approach to crypto regulation, with varying degrees of stringency and innovation. For instance, while the US made significant strides in regulatory clarity under the Trump administration, Europe grappled with the challenges of implementing MiCA across its member states. This divergence raises concerns about regulatory arbitrage, where crypto firms may seek out jurisdictions with the most favorable regulatory environments, potentially undermining the effectiveness of global regulatory efforts.

And this is the part of the report that I find genuinely puzzling. If the goal is to create a level playing field and combat illicit finance, how can we reconcile these stark differences in regulatory approaches? It's like trying to build a house with blueprints from a dozen different architects—the end result is bound to be a mess.

Argentina, for instance, expanded VASP registration requirements and introduced a legal framework for tokenized assets, but also faced controversy over a presidential memecoin scandal. Brazil finalized its regulatory regime for VASPs but dropped the use of blockchain technology in its CBDC project. El Salvador, the first country to adopt Bitcoin as legal tender, shifted its acceptance to a voluntary status. What's the common thread? Uncertainty. These jurisdictions are grappling with the inherent challenges of regulating a technology that transcends borders and defies easy categorization.

Road Ahead: Balancing Innovation and Risk

Looking ahead to 2026, the crypto industry faces a complex set of challenges and opportunities. The implementation of new regulatory frameworks, particularly in the US and Europe, will be crucial in shaping the future of the industry. The success of these frameworks will depend on their ability to strike a balance between fostering innovation and mitigating risks. As Julian Vance, I would say that the data is still coming in, and that it's too early to declare a clear winner.

But one thing is certain: the crypto industry is at a crossroads. It can either embrace responsible innovation and work collaboratively with regulators to create a sustainable ecosystem, or it can continue down the path of regulatory arbitrage and risk undermining its own long-term viability.

Regulation: Friend or Foe?

The central question remains: will these regulatory efforts ultimately help or hinder the growth of the crypto market? The answer, as always, lies in the details. If regulations are overly burdensome and stifle innovation, they could push crypto activity underground or offshore. But if they are well-designed and effectively enforced, they could create a more stable and trustworthy environment, attracting institutional investors and fostering wider adoption. It's a delicate balancing act, and the outcome is far from certain.

Bitcoin Slide: The Open Interest Puzzle (- Takeaways)

Next PostThis is the latest post.

Related Articles