Bitcoin Slide: The Open Interest Puzzle (- Takeaways)

It's 2026: Crypto Regulation Under Scrutiny

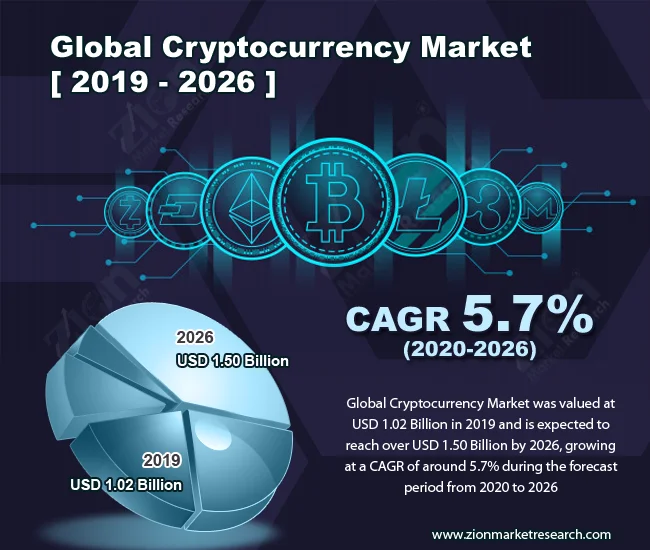

It’s 2026, and the crypto world is still trying to figure out if the Trump administration's policies are a boom or a bust. Last year was a whirlwind, with the GENIUS Act for stablecoins finally passing and regulators scrambling to catch up. But are these changes actually creating a more stable market, or just setting the stage for the next big crash? The initial reports offer some clues, but raise even more questions.

Parsing the Post-GENIUS Act Landscape

The GENIUS Act was supposed to be the game-changer, right? A clear regulatory framework for stablecoins, bringing them into the financial mainstream. But the devil, as always, is in the details. The Act mandates federal oversight of stablecoin issuers, requiring them to hold reserves and undergo audits. Sounds good on paper. But the implementation is already proving to be… let’s say, uneven.

The US Treasury is still working on the final regulations for the GENIUS Act, with a deadline of July 2026. That's a long runway, and in the meantime, we're seeing a patchwork of state and federal rules that create confusion and potential arbitrage opportunities. New York, for example, has tightened its capital and audit requirements, while Wyoming is pushing forward with its own state-issued stablecoin, FRNT. (A nice, if somewhat quixotic, experiment). The question is whether federal rules can truly wrangle the disparate elements.

And here’s where I get skeptical. The Global Crypto Policy Review Outlook 2025/26 Report highlights that while regulatory clarity has spurred institutional adoption – about 80% of surveyed jurisdictions saw financial institutions announce digital asset initiatives – that adoption is heavily skewed towards markets with "clear, innovation-friendly regulation." What happens in jurisdictions, or in specific sectors, where the rules are unclear or unfriendly? Does capital just flow elsewhere? That’s what the data suggests.

Consider the recent Bitcoin price slide. It's tempting to blame the Bank of Japan's rate hike, as some analysts have suggested. But Farzam Ehsani, CEO of VALR, points to another factor: the potential exclusion of major crypto-holding companies like Strategy from global indices. The fear of forced sell-offs is enough to weaken market structure and liquidity. Regulation, even well-intended regulation, can have unintended consequences.

A Global Regulatory Jigsaw Puzzle

The US isn’t the only player in this game. The TRM Labs report paints a picture of a global regulatory jigsaw puzzle, with different jurisdictions moving at different speeds and in different directions. The EU's MiCA framework is in effect, but implementation is proving to be "uneven," with national authorities diverging on their approaches. (The French, Austrian, and Italian regulators are already calling for stronger EU-level oversight). Meanwhile, countries like Brazil are forging ahead with their own VASP regimes, bringing crypto transactions under foreign exchange and payments oversight.

This lack of global consistency creates opportunities for regulatory arbitrage, as the FATF has warned. Illicit actors can exploit gaps in standards implementation to launder funds through unlicensed OTC brokers and decentralized exchanges. The North Korea hack on Bybit in early 2025, which resulted in over USD 1.5 billion in Ethereum tokens being stolen, is a stark reminder of this risk. This is the part of the report that I find genuinely puzzling. The data clearly shows that regulated VASPs have significantly lower rates of illicit activity than the overall ecosystem. So why is there so much resistance to consistent, global regulation?

Japan, however, is moving towards a flat 20 percent tax on cryptocurrency gains, a change that would replace the current progressive regime that can push rates above 50 percent for active traders. Lawmakers backing the plan say aligning digital assets with other investment products could draw liquidity back to domestic exchanges and boost overall tax receipts.

The numbers seems to back this up. Look at the performance of Bitcoin (BTC) which was priced at US$85,482.46, down by 6.4 percent over 24 hours. Ether (ETH) also experienced a steep decline, priced at US$2,757.79, down by 8.9 percent over 24 hours.

Will Altcoins Find Stability?

What about the smaller players? Altcoins like SPX6900 are still highly volatile, but some traders see potential for a recovery. The inverse head and shoulders pattern on SPX6900's trading chart suggests a potential price target that could lead to a 46% rally if a breakout occurs. But technical analysis is just one piece of the puzzle. Market sentiment and broader trends in the cryptocurrency arena also play a critical role. The data suggests that when liquidity returns to the market, altcoins tend to benefit.

But is this just wishful thinking? Are we just seeing a temporary resurgence fueled by hype and speculation? The S&P Global's recent downgrade of Tether (USDT) raises serious questions about the stability of stablecoins. S&P pointed to weaker reserve quality, shrinking cash-equivalent holdings, and rising exposure to secured loans and Bitcoin as reasons for the downgrade. This is the kind of discrepancy that keeps me up at night. The official narrative is "stability," but the underlying data suggests "risk."

The Coming Turbulence

In 2026, the crypto market is at a crossroads. The Trump administration's policies have created a new regulatory landscape, but it's still unclear whether this landscape will be stable or volatile. The GENIUS Act has the potential to bring clarity and legitimacy to stablecoins, but its implementation is proving to be challenging. Global regulatory inconsistencies create opportunities for arbitrage and illicit activity. And the underlying risks in the stablecoin market remain a cause for concern.

Boomtown: What It Is, Casino to Brewery – The Full Picture

Next PostCrypto Forecasts: Why Your 2025 Predictions Are Wrong

Related Articles